More insight into the changing behaviours of property buyers in Vilnius and Kaunas is provided by a survey which was commissioned by real estate management company Citus and conducted by Spinter Research in October-November 2020.

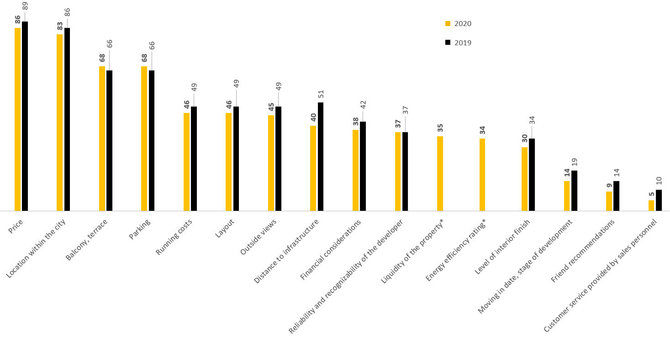

The survey asked all respondents to choose the most important criteria out of 17 possible options when searching for a property. The first significant change compared to the survey conducted in 2019 was the decreased weight (3-11% less) of almost all criteria. Only one out of 17 categories has increased in importance and one remained unchanged.

As before, price and location remain the most important factors in choosing a property. In the 2020 survey this criterion was indicated by 86% and 83% of respondents respectively (89% and 86% in 2019). Parking was the only requirement shown to have increased in importance: from 66% in 2019 to 68% last year).

According to Ignas Zokas, head of Spinter Research, female respondents tended to prioritise the price of the property, its layout, a balcony or a terrace and the financial conditions for making a house purchase, whereas the location within the city was most important to those with higher income (710-1,000 EUR). Male respondents and people with the highest income (1,000 EUR and above) indicated potential maintenance costs as an important factor, meanwhile women and those with higher earnings noted the available infrastructure. The residents of Vilnius also prioritised the reputation of the developer.

Figure: Criteria for choosing property 2020 vs 2019. Data of CITUS* Some of the categories were included in the questionnaire in 2020

Important decision

Andželika Keršytė, head of sales at Citus, stresses that buying a property is one of the most important decisions in people’s lives so it should not be taken without a thorough research. Keršytė notices that once the first lockdown ended and the second one began more people started buying properties for their children, although some of them were still at school.

“The situation last year was unprecedented. Most people’s income didn’t change much and there was a lot of talk from the experts on increasing savings and savings accounts. Additional saving was made possible by the decrease in expenses during both quarantines. We can therefore assume that the increased activity in the property market and the rising prices prompted many people to consider investing into the future. Very often the people intending to buy suitable properties for their children came from other areas of the country who were planning for their offspring to settle down, perhaps study in Vilnius or Kaunas,” explains Keršytė.

However, it is worth noting that these decisions may be influenced by the current situation rather than being the result of careful planning. The relatively small but significant changes in how properties are being chosen may have been driven by some of the afore-mentioned buyers who may not necessarily prioritise the criteria which was previously considered important in choosing a property.

According to the survey, reputation, reliability and recognizability of the developer is still considered as important as before. This was confirmed by 37% of respondents both in 2019 and in 2020. Keršytė emphasises that many developers with no experience or a long-term strategy may be attracted by the current upheaval of the property market. These firms are often only chasing quick profits, they may not be able to complete their projects and could put considerable investment of their customers at risk. So researching the developer’s track record, their experience and the projects they have completed is crucial.

Interior finish, on the other hand, is the factor which is continuing to decrease in importance.

Things to know when choosing a property

Generally, people are likely to move several times during their lives. So it is very important to choose a property carefully, considering the future needs of the residents and foreseeing any factors which would make selling the property easier in the future. Andželika Keršytė lists the most important steps to be taken in order to successfully complete a property purchase.

1. Consider how long you are planning to live at the property and identify your needs. Trying to purchase a suitable life-long home is not an effective strategy. It is useful to clarify your own needs for the property and research the advantages of available developments. Do not rush, try to visit at least 5 developments. Very often people know what size their property should be, how many rooms it should have, which floor they would like to live on. But not enough analysis is done on technical and social aspects. When planning a budget, it is useful to set the minimum and maximum amount you are prepared to spend on the property.

2. Assess the property’s liquidity. Moving home is no longer a once-in-a-lifetime event so when your family circumstances and needs change or you start dreaming of a new place, it is important to be able to successfully sell the current property. The property’s liquidity depends on its location and the potential of the area in 5-10 years’ time. Infrastructure, any technological and social solutions available in the property are also important. To help assess the location and its potential the help of a professional can be enlisted, it is also worth researching the development plan of the city for the next 5 to 10 years.

3. Perform a comprehensive assessment of the price. Consider not just the amount of the mortgage (if you are buying through a bank) but also the monthly costs and other expenses which may arise from your choice of property, such as the running costs (depending on the energy efficiency rating), travel costs from the property to the place of work, school, or kindergarten. In the long run the most valuable properties will be those which have the most advanced, alternative heating solutions and homes which have been awarded the highest energy efficiency rating. It is also important to note other aspects of the development, such as comfort, security, social and other aspects which may increase its value.

The actual value of the property and the “fair price” can be researched using the portal www.ntsandoriai.lt. It contains information on the price similar properties have been sold for (the actual value of completed purchases). Choose the search criteria carefully to find properties in similar locations or in similar size buildings. Although there is a small fee for this service (a few euros for a list of 10 transactions), the information may prove very valuable when negotiating your own purchase.

4. Only select a trustworthy developer. Research the firm: how many years of experience they have, which projects they have completed successfully, which are currently being developed, any awards won, which associations they are part of. Ask your friends and colleagues, search for information online or on Facebook. Choosing an unreliable developer puts you at risk of losing your deposit. But during the worst-case scenario you could face the threat of losing all the guarantees if the developer goes bankrupt. Rectifying any unsatisfactory jobs will also become the owner’s responsibility and add extra costs.

5. Do not be tempted by discounts and perks. Property sellers may seek to attract potential buyers by offering various discounts and gifts such as holiday trips, kitchen appliances and similar. But it is important to select a suitable property based on physically visiting it and researching its benefits rather than be seduced by discounts, which most of the time are included in the price anyway.

The survey commissioned by Citus and conducted by Spinter Research during the period of October-November 2020, included 507 residents of Vilnius and Kaunas who have either purchased a home within the last 5 years or were planning to do so within the next 3 years. The survey was conducted online by completing a questionnaire.

Facts and numbers – key criteria for choosing a property

- Price – 85.8% of respondents (88.5% in 2019)

- Location within the city – 82.8% of respondents (85.6% in 2019)

- Parking – 67.9% of respondents (66.3% in 2019)

- Layout (spacious or compact; specific number of rooms) – 46.2% of respondents (48.5% in 2019)

- Balcony, terrace – 44.6% of respondents (48.9% in 2019)

- Running costs – 43.6% of respondents (55% in 2019)

- Outside views – 40.6% of respondents (49.3% in 2019)

- Infrastructure (distance to schools, shopping centres) – 39.6% of respondents (49.3% in 2019)

- Financial considerations (size of deposit, spreading of payments, loaning from banks) – 38.3% of respondents (42.3% in 2019)

- Developer’s reputation (reliability and recognizability of the developer) – 36.9% of respondents (37% in 2019)

- Liquidity of the property (new category for 2020) – 37.7% of respondents

- Energy efficiency rating (new category for 2020) – 33.5% respondents

- Level of interior finish (fully finished or not) – 29.6% of respondents (33.7% in 2019)

- Moving in date, stage of development (being built or completed) – 14.4% respondents (18.9% in 2019)

- Friend recommendations – 8.5% of respondents (13.8% in 2019)

- Customer service provided by sales personnel – 4.7% of respondents (9.6% in 2019)