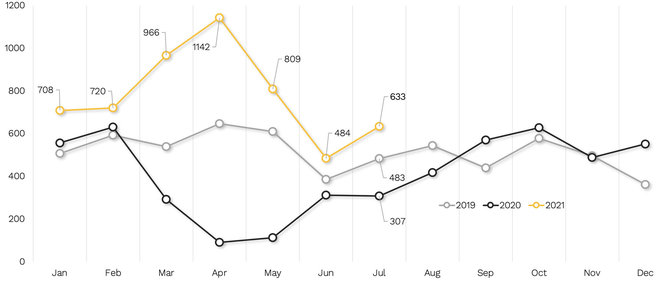

“Considering the seven-month housing market dynamics for Vilnius, it is higher this year, but the trajectory is completely in line with the recent monitoring data from Citus. This reveals several things: firstly, I think that we can confidently say that the market will no longer fall beneath last year’s threshold; and secondly, it appears that the market has stabilised, and we shouldn’t see any sudden changes in pricing or sales, which is good news for everyone,” says Šarūnas Tarutis, the head of investment and analysis at Citus, a housing project management company.

He also notes that in terms of market size, the capital has reached a similar level to that of similar Northern and Central European cities – so far, the seven-month result (5,462 new apartment reservations overall) reached 780 reservations per month, and is 50 percent higher than the year 2019 when 518 housing units where reserved each month.

According to Citus analysts, supply has almost caught up to demand after a very long time. Over 600 apartments offered to the market in new projects or their stages over the month resulted in 3,868 units in the supply chain by the end of July compared to 3,898 at the end of June. Nevertheless, some of the reservations in July transitioned from prior months, and the supply should have grown. Assesing those facts stability and consistency on the market in the near future is expected by the experts.

In July, Citus even recorded a statistical decrease in average pricing on the primary housing market in Vilnius – a square metre in new projects costed an average of 2,353 euros last month versus 2,365 euros in June.

“Looking at absolute numbers, you could be a little misled – we can see that there was more economy and middle-segment property delivered to the market last month with lower prices. However, this nonetheless indicates that the pricing has stabilised. At the period of peak activity during March and April, the monthly price increase reached 4.5 to 5.1 per cent, while over the past three months, growth has fluctuated between -0.5 and 1.8 per cent,” a Citus expert notes.

Table No. 1: Vilnius housing market dynamics 2019-2021

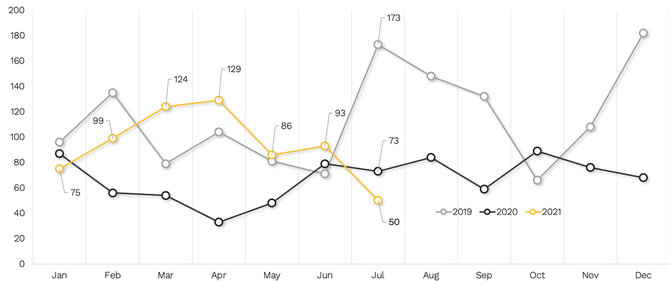

As mentioned, only 50 new apartments and terraced houses were reserved in Kaunas during July. A lower result was only recorded last year during the market freeze in April and May. However, in 2019 and throughout all of 2021, sales were more numerous, and in July 2019, the second-best historical result in Kaunas was recorded with 173 new apartments and terraced houses reserved.

“It comes as no surprise that the housing supply is filling up at a faster rate in Kaunas – from the end of June to the end of July, it increased by 14 per cent from 1,049 to 1,200 units. Prices continue to grow faster in Kaunas than Vilnius this year, but the market has greatly shrunk, and so even a single project can significantly change the combined price level. I do not think that this was the reason that led to such low market activity, and so I can only assume that Kaunas residents are currently actively engaged in holidaymaking and will return to seeking for home in autumn,” Tarutis explains.

Table No. 2: Kaunas housing market dynamics 2019-2021

This article was edited by professional copywriter and proofreader Vicki Leigh. Find out more about her expert writing and editing services at twoflowercactuscreative.com