The Lithuanian start-up's founder Viktorija Vanagė celebrates that alternative financing is taking an increasingly significant role in the loans sector and that Lithuanians are increasingly aware that funds lying in their accounts must be put to work.

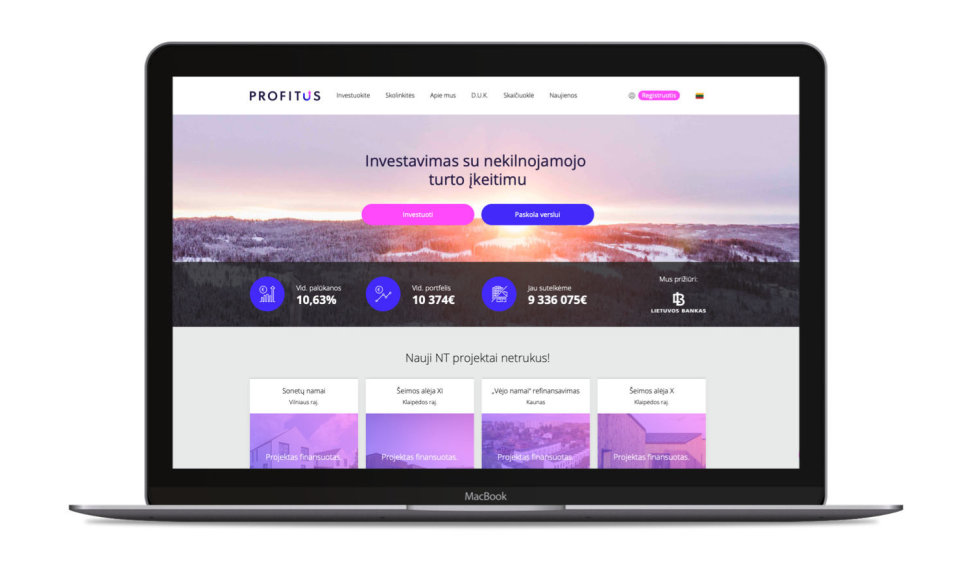

"Over this brief period of one and a half years, we have become one of the market leaders and can offer alternative financing to not only businesses. We can allow even those without vast capital to employ their money from as little as 100 euro," the founder and head of Profitus stated.

The Profitus platform counts a community of more than 5,700 investors, which has already earned more than 380 thousand euro.

33 million by the end of the year

Profitus plans even higher growth in 2020 and seeks to reach 33 million euro in crowdfunded projects.

"We have increased both investor confidence and recognition in the business domain; thus, the momentum we have will allow us to reach even more. We plan to have crowdfunded projects worth more than 33 million euro by the end of the year. Without a doubt, the growth will be significantly increased by how we can currently offer particularly competitive interest rates to businesses, starting from just 7%. This will allow us to attract larger and more reliable projects," Viktorija Vanagė states.

She also adds that this year, they will not limit themselves to solely the domestic market and will also place much attention on expansion and developing loan product offerings abroad.

"We intend to offer business clients new loan products and for investors – more investment opportunities also outside of Lithuania. Without a doubt, the platform's technical improvement is also important; thus, we intend to present a secondary loan market. We are already preparing a new version of the platform, which will be even more user-friendly," Viktorija Vanagė states.

In total, over 2019 Profitus received 113 applications for 42 million euro, albeit selecting and financing only 20% of the projects. Currently, investors have earned an average 10.39% annual interest on the platform.