Today the world is experiencing a new crisis, a health-related one, with significant and, unfortunately, negative impact on the economies. So banks must once again review funding policies and businesses are once more facing funding challenges.

However, Lithuania now has much more diverse alternative financing opportunities than it had more than a decade ago, including the crowdfunding market overseen by the Bank of Lithuania, with clear rules and requirements and the economy and households have accumulated a significant number of funds which, if invested, could yield profit.

Falling interest rates open new borrowing opportunities for business

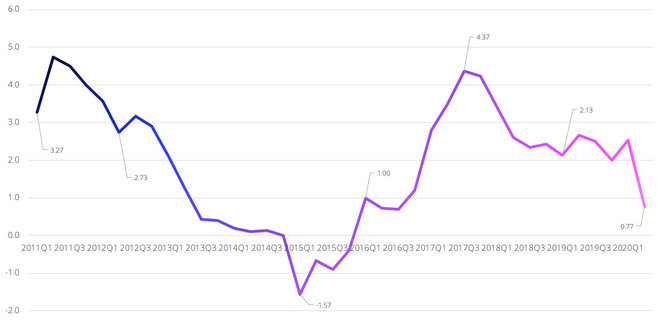

In the Eurozone, in the context of the last ten years, the real estate (RE) mortgage interest rate (which has a significant impact on the final price of RE), has been constantly declining, according to the data provided on the portal TheGlobalEconomy.com.

Graph 1: RE mortgage interest in the euro area, 2011–2020 (source: www.theglobaleconomy.com)

It is also declining in major European economies, i.e. Germany, the United Kingdom, France, Italy, the Netherlands and others. And even though interest rates have not dropped in Lithuania recently, this can be explained by a sufficiently concentrated and poorly competitive bank lending market.

Graph 2: Real estate mortgage interest in Germany, Great Britain, France, Lithuania, 2011–2020 (source: www.theglobaleconomy.com)

Investment in Lithuania in real estate projects under development occupies the largest share in the market of alternative lending, i.e. crowdfunding, but the declining borrowing rates are also relevant for Lithuanian business.

"We have noted that recently interest rates are also being brought down by crowdfunding platforms operating in Lithuania. This is a positive sign because it corresponds with the global trends and, moreover, it promotes competition in our market not only among alternative lending platforms but also with credit unions which, to date, have traditionally been able to offer more favourable terms. Latest projects funded by PROFITUS with record low (6%; 7.5%) interest shows that investors are willing to lend at lower interest rates, but also with extremely low risk,” says Viktorija Vanagė, founder and CEO of PROFITUS.

According to Ms Vanagė, the decline in lending interest rates will happen in Lithuania as well. Although, as mentioned above, the interest rates of traditional real estate loans in Lithuania are not decreasing at present, the declining alternative lending rates will squeeze competition with conventional lenders and improve the conditions for lending to businesses and real estate developers. There is also no shortage of potential: in Lithuania, alternative lending makes up only about 1% of the borrowing market, while, for example, in the neighbouring countries of Latvia and Estonia this share is about 5-6%.

“The Bank of Lithuania supervises the market very strictly and tolerates low risk. We are also on the low-risk tolerance path and we can offer investors safe projects for their investments. Predictable returns and confidence, security in our market, especially in this period, are critical, therefore, cases such as in Latvia, where investors used to lose money due to less vigilant oversight of the market, in the hope of high returns, it is almost impossible here," said the founder of Fintech company.

Quarantine lessons: challenges for developers and investor confidence

The real estate market has come to a halt during the quarantine: developers reconsidered planned projects and investments and investors became more vigilant and cautious. However, these two parties faced different challenges.

"As far as I had to interact with various developers, at the beginning of the quarantine, some of them decided to suspend their investment plans until the situation becomes clearer and more predictable. However, there were many of those who had planned new projects before quarantine and decided to continue with them. Nevertheless, during the period of global uncertainty, banks began to view the real estate business as a high-risk sector and became even more cautious about lending to them. This has become a real challenge for real estate developers,” says V. Vanagė.

As a result, some developers began to look for alternative sources of borrowing necessary to continue operations.

"Naturally, one would ask: in the light of predominant uncertainty about the future, have people not decided to accumulate their money and have at least considered lending them to business through platforms? Our experience during quarantine shows that it was not the case: projects were funded quickly, and, additionally to consider, are our short processing times, compared to other lenders, we became an excellent 'second choice'. So the total number of projects co-financed during the quarantine was very high,” says the CEO of PROFITUS.

According to her, people, having more free time and spending more of it online, were more likely to find an opportunity to invest in crowdfunding platforms – in half a year the PROFITUS investor community has grown as much as it has increased throughout the whole of last year.

Still, investors were very cautious and were willing to diversify their investment portfolio. As a result, the average investment decreased, however, the total concentrated amount remained very similar to the previous period last year and investor activity increased. According to information from PROFITUS, three-quarters of investors have invested in more than one project and more than half of them – in more than 4 projects.

"This shows that investment is taking place, access to financial resources for business is fast and sufficiently convenient, which is a positive signal for the whole economy," Viktorija Vanagė was satisfied with the confidence of investors.

Growing household financial assets are “eaten” by inflation: EUR 1.7 billion additional deposit values after the quarantine

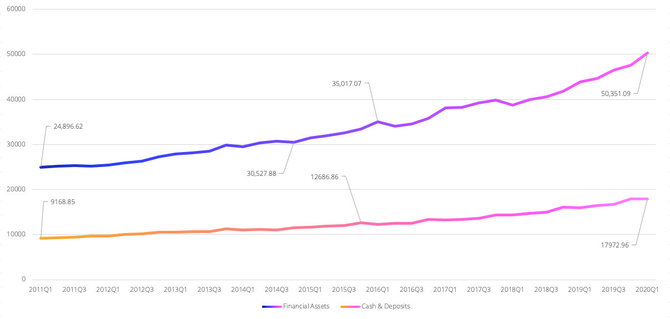

According to the Bank of Lithuania, over the last 10 years, the financial assets of Lithuanian households (cash and deposits, equity instruments, investment fund shares, pension schemes, etc.) have more than doubled, from EUR 24.9 to EUR 50.4 billion.

Graph 3: Financial assets, money and deposits of Lithuanian households, 2011–2020 (source: Bank of Lithuania)

In assessing this year's situation, the Bank of Lithuania announced that household deposits (including non-profit institutions serving households) totalled EUR 15.5 billion at the end of the first quarter of 2020 and were 11.2% higher than in the same period last year. Meanwhile, the number of deposits increased by almost a further EUR 1.7 billion in the second quarter of this year.

Graph 4: Deposits of Lithuanian households, 2011–2020 (source: Bank of Lithuania)

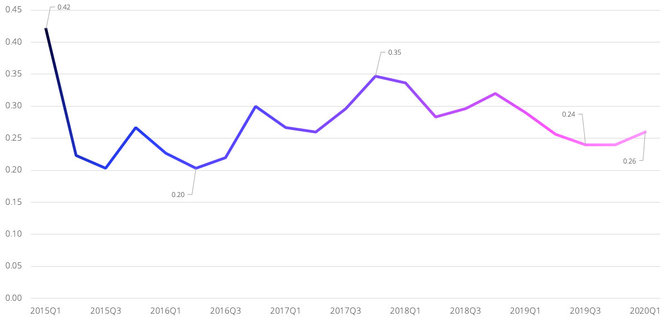

On the other hand, during the same 10 years, total inflation, according to the information provided by Statistics Lithuania, amounted to as much as 17.1%. Meanwhile, interest rates on household deposits have dropped from 0.54% to 0.17% in five years, according to the Bank of Lithuania, thus staying well below inflation. This means that, for example, in the first quarter of this year, when households had EUR 15.78 billion in deposit values and EUR 2.20 billion in cash, the average monthly inflation was about 2.53% and interest on deposits 0.26% – hypothetically more than 400 EUR billion were lost on deposits and cash depreciated by EUR 55 billion. That's almost a EUR 464 billion loss per year!

Graph 5: Change in consumer prices (inflation), 2011–2020 (source: Statistics Lithuania)

As wealth and inflation rise and deposit interest rates fall, this amount can only grow and so, therefore, people are looking for ways to use their money.