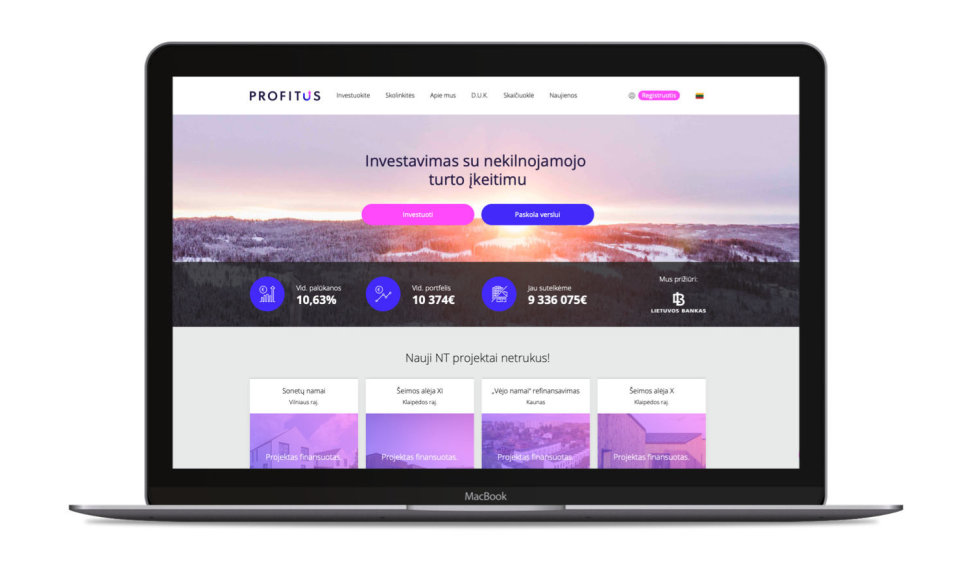

It is estimated that since its launch on the 8th of August 2018 the platform crowdfunded 9.3 million euros and funded 54 projects in total. It is because of these achievements that eu-startup.com has named Profitus as one of the ten most promising startups in Lithuania to be followed in 2020.

Profitus investors have already earned more than 334,000 euros through the platform and investors are offered to employ money through the platform at an average annual rate of 10.65 %.

Currently, Profitus has more than 5,000 registered investors, with a loan-to-value (LTV) ratio averaging only 51 %.

In 2019, the platform funded only projects in Lithuania, but it also accepts investments from across the European Union. Although Profitus offers an investment starting from 100 euros, the average investor portfolio currently stands at 10,374 euros and the average investment is 2,437 euros.

In 2019, the average investment maturity was 11.34 months, and projects were funded on average within 6 days.

In 2019, Profitus received a total of 113 applications for 42 million euros, however, only part of them were selected and funded.

New year goals

Profitus is looking forward to an even higher growth in 2020, while expecting no profit yet, as it intends to invest in development.

“By the end of this year, we will seek to fund projects worth of 33 million euros. To achieve this, of course, we need to go into other markets and not just look for investors, but also finance projects. So, we plan to invest in the development abroad in 2020,” Viktorija Vanagė, the founder and CEO of Profitus, says.

She adds that they will also offer more new loan products this year, focusing on the technological development of the platform.

“We intend to offer new loan products to business customers and more investment opportunities to investors. Of course, the technical development of the platform is also very important. We intend to introduce the secondary loan market and the option of investment sweep. A new version of the platform, which will be even more user-friendly, is already in the making,” Viktorija Vanagė says.

The Profitus platform was launched on the 8th of August 2018; it is licensed and supervised by the Bank of Lithuania.